Stock market | Financial content business page

A Michigan-based SEO firm has helped several small business clients grow their web pages and increase organic traffic through search engines.

Grand Rapids, Michigan – January 5, 2023 —

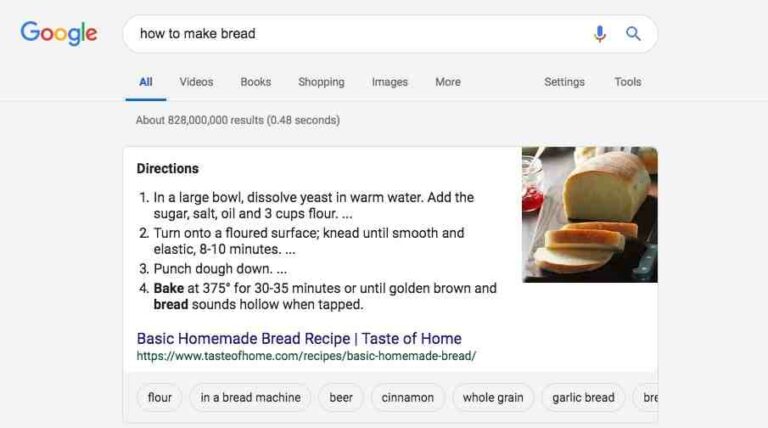

For many Michigan small businesses, it’s a constant struggle to stay afloat. With a lot of competition, solutions are needed to get as many customers to their door as possible. A local SEO agency is trying to make this happen by using the latest SEO technology to help businesses improve their search rankings. Nation Media Design is the company in question, which uses a range of techniques to drive organic SEO growth, see customers rise in search results, and gain visibility. As a result, it leads to increased brand awareness and an increase in organic traffic for local businesses in the area.

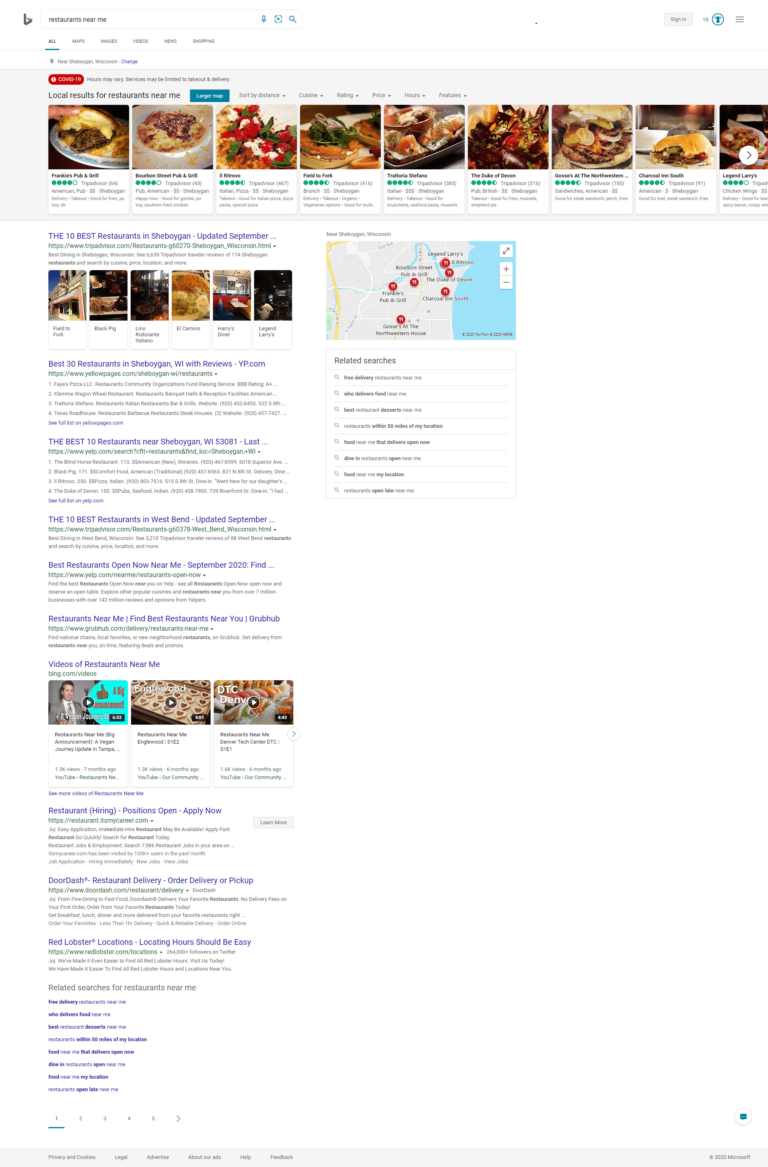

Using local SEO for small business clients

Nation Media Design is based in Grand Rapids and serves the surrounding area. Therefore, the customers are mostly local businesses in the area. This creates unique challenges when dealing with an SEO campaign, as the focus must be on local SEO.

Local SEO is a form of search engine optimization aimed at ‘local’ search results. Essentially, focusing on local SEO means companies are seen when people from the same geographic area start searching for recognizable key terms. It also means that anyone looking for businesses in Michigan is more likely to see companies with good local SEO.

Of course, the prospect of SEO and local SEO is daunting for many small businesses in the area. This is where Nation Media Design steps in to provide a comprehensive service that uses technology to improve organic rankings in search engines.

Achieving real growth for customers

Over the years, this SEO agency has helped many small businesses achieve real growth. Clients range from electric vehicle manufacturing companies to web design firms. Thanks to the SEO technology used by the Nation Media team, one client saw an organic traffic increase from 1,083 visitors to 2,657 visitors per month. Similarly, another client saw a 334% increase in traffic during the project, with organic traffic tripling in one month alone!

The bottom line is that the world is changing; everything is digital these days. Michigan small businesses are starting to realize that the online world is extremely important and they need websites with a strong presence in search engines. Agencies like Nation Media are here to provide real results that last. The company plans to build on its existing success by helping companies improve search rankings, both now and in the future.

Nation Media Design is a full service digital marketing & SEO agency built with local businesses in mind. Using digital winning strategies, the agency helps businesses see more wins in SEO, Google PPC, and social media marketing to drive sales and revenue.

For more information, check out the website here: https://nationmediadesign.com/.

Contact Information: Name: Kaleb Nation Email: Send Email Organization: Nation Media Design Phone: 6168885050 Website: https://nationmediadesign.com/

If you discover any issues, problems or errors in the content of this press release, please contact error@releasecontact.com to notify us. We will respond within 8 hours and rectify the situation.

Can you open an LLC for stock trading?

Once organized under state law, an LLC can do many of the same things as individuals, including buying stock.

Does LLC Pay Tax on Stocks? The LLC is taxed as a pass-through entity, meaning there are no shares associated with the company. All taxes are withheld from the personal income tax of the members and the pay slips of the employees. Unlike an LLC, a company does own shares and its members or owners will have to pay double taxes.

Should you open an LLC for stock trading?

You can form an LLC to invest in stocks to protect your personal assets from lawsuits or corporate debt. Limited liability companies (LLCs) are popular business structures because they have the simplicity of a sole proprietorship without the legal exposure.

Can you make a living of stocks?

Trading is often seen as a profession with a high barrier to entry, but as long as you have both ambition and patience, you can trade for a living (even with little to no money). Trading can become a full-time career opportunity, a part-time opportunity, or simply a way to generate supplemental income.

Can you really make a lot of money in stocks? Investing in the stock market is one of the smartest and most effective ways to build wealth for a lifetime. With the right strategy, it’s possible to become a stock market millionaire or even a multimillionaire — and you don’t have to be rich to get started.

Can you make a 1000 dollars in a day with stocks?

Despite a work ethic being required, making $1,000 a day is still very doable. Some opportunities don’t require you to learn any new skills. To make $1000 a day from popular stock options, you need to know how to buy and sell stocks at the right time.

What is the fastest way to make $1000 dollars?

How To Make $1000 Fast – 22 Ways To Make Money Fast

- Take online surveys.

- Deliver food.

- Rent out your unused space.

- Rent your car.

- Open a new bank account.

- Earn money when you buy gas.

- Earn cash back when you shop.

- Pet sitting and dog walking service.

Is $1,000 a day good?

How much is $1,000 per day? Before you start, it’s important to understand how much money is a thousand dollars a day. Earning $1,000 daily is equivalent to earning $365,000 per year. This is a great income for the vast majority of people and would put you in the top 1% of earners.

How to make $1,000 dollars a day in the stock market?

To earn $1,000 a day, you need to invest $100,000, an amount that is enough to fund your retirement for a long time. Or start with small investments for individual stock options and flip your stocks for a shorter term. For simplicity, it can be broken down between equity and cash investments.

Can you become a millionaire just from stocks?

Investing in the stock market is one of the most effective ways to build wealth and it is even possible to achieve millionaire status. While you don’t have to be rich to become a stock market millionaire, you do need the right investments.

How much do you need to invest in stocks to become a millionaire?

$1 million the hard way If you’re starting from scratch, online millionaire calculators (which yield different results with the same entry) estimate that you should save somewhere between $13,000 and $15,500 a month and invest it wisely enough to make money. earn an average of 10% per year.

Is it possible to get rich from stock market?

While this is quite difficult to achieve, it is by no means impossible. There have been many cases in the modern world where investors have become rich through their investments in stock markets. 1 What are investment options in stock markets?

How to become a millionaire through stocks?

7 strategies to become a millionaire with stocks

- Invest in yourself.

- Save money.

- Minimize taxes on investment profits.

- Keep investment costs low.

- Invest in stocks.

- Choose the best stock investments.

- Invest every month.

Can stocks alone make you rich?

Can a person get rich by investing in the stock market? Yes, you can get rich by investing in the stock market. Investing in the stock market is one of the most reliable ways to grow your wealth over time.

How can I make $1000000 in stocks?

If you start investing in the stock market at age 30, you only need to contribute $5,000 a year to reach the million dollar milestone by age 65. By comparison, if you wait until you’re 45 years old, you’d need to invest $20,000 a year to reach that same $1 million by age 65.

Can you make a million dollars in a year with stocks?

To estimate how long it might take you to make a million dollars in the stock market, you can use a projected long-term return of 8.5% annualized. If you start investing in the stock market at age 30, you only need to contribute $5,000 a year to reach the million dollar milestone by age 65.

Can you make 1 million in the stock market?

Over the past three decades, the S&P 500 has generated total returns of 1,770%, equivalent to an annualized return of 9.9%. At that rate, a $100 weekly investment would grow to a $1 million portfolio in just under 32 years.

How do you make millions off stocks?

How to get rich from stocks

- Develop an investment strategy. Your investment strategy is a set of rules or guidelines to help you decide when to invest or not. …

- Choose an investment style. …

- Use Index Fund Investing. …

- Buy and sell individual stocks. …

- Buy and hold quality stocks and ETFs. …

- Consistently contribute money.

Where can I look at stock charts for free?

Best Free Stock Charts

- StockCharts. com.

- ThinkorSwim.

- Yahoo Finance.

- Finnish.

- Trade view.

Is there a free version of StockCharts? With our trial period, the first month of the service is completely free. You can cancel at any time during the trial month and you will not be charged. All new trial accounts start at our Extra service level, but you can upgrade or downgrade at any time during the free month.

What is the 72 rule in stocks?

Do you know the rule of 72? It’s an easy way to calculate how long it will take for your money to double. Just take the number 72 and divide it by the interest you hope to earn. That number gives you the estimated number of years that your investment will double.

Does the rule of 72 still apply? The Rule of 72 applies to compound interest rates and is fairly accurate for interest rates that fall between 6% and 10%. The rule of 72 can be applied to anything that increases exponentially, such as GDP or inflation; it can also indicate the long-term effect of annual fees on an investment’s growth.

Why do investors use the Rule of 72?

Rule of 72 During Inflation Investors can use the Rule of 72 to see how many years it will take for their purchasing power to halve as a result of inflation.

Why do economists use the Rule of 72 instead of 69?

Use the rule of 69.3 for maximum accuracy, especially for continuously compounding interest instruments. The number 72 has many useful factors, including two, three, four, six and nine. This convenience makes it easier to use the rule of 72 for an accurate approximation of compounding periods.

Why do we use the rule of 70 instead of the Rule of 72?

The rule of 72 is best for annual interest rates. On the other hand, the rule of 70 is better for semi-annual compounding. Suppose you have an investment with an interest rate of 4% that is compounded semi-annually or twice a year. According to the rule of 72, you get 72 / 4 = 18 years.

Does the Rule of 72 work for stocks?

The rule of 72 is fairly accurate for low returns. The chart below compares the numbers given by the rule of 72 and the actual number of years it takes an investment to double. Note that while it provides an estimate, the rule of 72 is less accurate as returns increase.

Is the Rule of 72 still accurate?

The Rule of 72 works best in the 5 to 12 percent range, but it’s still an approximation. To calculate based on a lower interest rate, such as 2 percent, drop the 72 to 71; to calculate based on a higher interest rate, add one to 72 for every three percentage point increase.

What is the 7% rule for investing?

To make money in stocks, you need to protect the money you have. Live to invest another day by following this simple rule: Always sell a stock when it is 7%-8% less than what you paid for it.

Does Rule of 72 apply to stocks?

The Rule of 72 is a quick, simple financial literacy tool for determining if your investments, stock portfolio, 401(k), or other retirement accounts are adequate when needed. It can show how long your financial investments will double in value.

What is Rule of 72 explain rule with example?

The rule of 72 is a numerical concept that predicts how long an investment will take to double in value. It’s a simple formula that anyone can use. Multiply 72 by the annual interest rate on your savings to determine how much time it will take to increase your investments by 100%.

How can the Rule of 72 can be used for your personal success?

The rule of 72 can be used to estimate the following: At a fixed annual rate of return, how long will it take for an investment to double. The estimated number of years it takes an investment to double. That composition can have a significant impact on the time it takes to double an investment.

Why is it called the Rule of 72?

For example, the rule of 72 states that it would take 7.2 years ((72/10) = 7.2) for $1 invested at a 10% annual fixed interest rate to grow to $2. In reality, an investment of 10% take 7.3 years to double ((1,107.3 = 2). The rule of 72 is fairly accurate for low returns.

How long to double money at 7 percent?

With an estimated annual return of 7%, divide 72 by 7 to see your investment doubling every 10.29 years.